Community Update #1

Lithgow Council has commenced an extensive process of community engagement on two options to ensure the long-term financial sustainability of the council.

Option 1 – Service levels are able to be maintained. Council can:

- Maintain roads, footpaths, town centres, villages and buildings to a level agreed with the community.

- Renew public infrastructure in a timely and planned way.

- Maintain all current services to the community, including playing fields, parks, aquatic centre, libraries, community facilities, disaster recovery, stormwater etc.

- Improve its financial sustainability and performance, with special attention directed to expanding and diversifying the local economy – more jobs.

Option 2 – Service levels are reduced. Council will

- Present a plan that reduces the provision of infrastructure and services to align with existing Council revenues.

- Reduce services for community and recreation facilities and services and close unsafe facilities.

- Continue to reduce services over future years as short-term service level reductions will not be sufficient to ensure essential assets reach assumed asset lives.

What we’ve heard from you

What will Council do to support people who can’t afford a rate increase?

Council understands that it is a difficult decision to substantially increase rates and has carefully considered rating increases across all rate categories.

Council has a Hardship Policy to accommodate the special needs of those unable to pay their rates in full on time and will support those who request assistance.

Council is also very pleased to maintain the Pensioner Rebate Scheme, which financially supports this important cohort in our community.

It looks like the financial situation has been bad for years, why did you wait so long to think about how to fix it?

Over recent years, Council has taken decisive action to contain costs and increase its own-source revenue. Rising costs have not kept pace with income that is set by IPART and challenged Council’s ability to maintain

our local community’s assets and deliver the outcomes residents want.

Council has carefully assessed all options and considers seeking a Special Rate Variation to be in the best interests for community.

Is Council $6M in debt? Or is there a shortfall in funding?

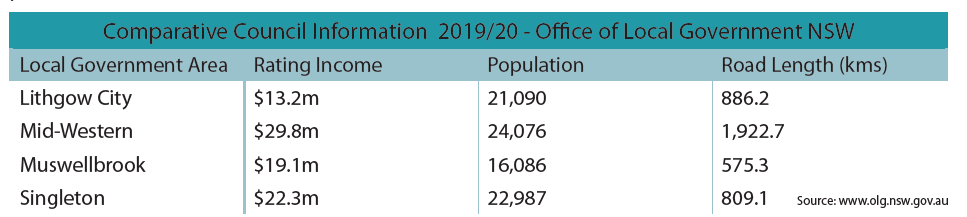

The rating review identified an annual shortfall in Council’s General Revenues of $6.018 million at existing levels of service before adopting available productivity, savings and other measures. Lithgow’s land rating Income (excluding water, sewer and domestic waste) is very low compared with Comparable Councils. This comparison explains why there is a shortfall of funds needed to deliver the diverse range of services we provide.

Council’s road maintenance budget allocation is approximately $500,000 p.a. less than that required to meet the associated level of service expense. Additionally, most of the $5.518m remaining shortfall relates to infrastructure (mostly road) renewal.

Council has around $12.7M of outstanding long-term loans for infrastructure projects. Loan repayments are planned and paid as they fall due. The planned borrowings have not impacted Council’s current financial position.

Will there be an independent person involved so that we know our money is going to the right things?

Council is both independently internally and externally audited. Additionally, Council is regulated by the NSW Department of Planning, Infrastructure and Environment which has a mandate to assist councils with continual improvement and to monitor council performance. IPART also requires Council to report on the expenditure of any Special Rate Variation (SRV) annually to its community.